The president of a Georgia-based telemarketing company will pay $300,000 to settle Federal Trade Commission charges that his company “abandoned” millions of calls when consumers answered their telephones. The FTC also alleged that the defendants made thousands of illegal calls to consumers who had told the company that they did not wish to be called.

According to the FTC’s complaint, JAK Productions, Inc. and its president John Keller, worked as “telefunders” – for-profit telemarketers who call potential donors seeking donations on behalf of charities. JAK operates out of Atlanta, Georgia, and has used call centers in West Virginia.

It is not illegal for telefunders to call telephone numbers on the FTC’s Do Not Call Registry, but consumers can stop such calls by telling telefunders and charities to place their number on the charity’s internal do-not-call list. All telemarketers, including telefunders like JAK, are required to honor such requests.

Telefunders and other telemarketers are also required to limit their use of automated “predictive” dialers. Such dialers can place calls so rapidly that there are not enough telemarketing representatives to handle the calls when they are answered. When an automated dialer fails to connect a call answered by a person to a live representative of the telemarketer within two seconds, the call is “abandoned.” The FTC’s Telemarketing Sales Rule requires that telemarketers limit the use of these dialers so that they do not abandon more than three percent of the calls that are answered by a person. The Rule also requires that telemarketers connect any calls that are not connected to a live operator to a recording that identifies the caller by name and telephone number.

The FTC’s complaint alleges that JAK violated the Telemarketing Sales Rule by abandoning more than two million calls. The agency also contends that the defendants violated the Telemarketing Sales Rule by making thousands of calls to consumers who had previously asked for their numbers to be placed on the do-not-call list of the charity for which JAK was calling.

The settlements with JAK and Keller prohibit them from violating the Telemarketing Sales Rule and include reporting and monitoring provisions to ensure they comply with the stipulated orders. The order against JAK also imposes a civil penalty of $1.45 million, which has been suspended due to the company’s inability to pay. If it is later found, however, that JAK misrepresented its financial condition, the full amount would immediately become due. The order against Keller requires him to pay a $300,000 civil penalty.

The FTC vote approving the complaint and proposed settlement orders, which took place before Commissioners Ramirez and Brill joined the agency, was 4-0. The complaint and orders were filed by the Department of Justice on the FTC’s behalf on June 29, 2010, in the U.S. District Court for the Northern District of Georgia.

NOTE: The Commission issues a complaint when it has “reason to believe” that the law has been or is being violated, and it appears to the Commission that a proceeding is in the public interest. The issuance of a complaint is not a finding or ruling that the respondent has violated the law. Stipulated final orders are for settlement purposes only and do not constitute an admission by the defendant of a law violation. Stipulated orders have the force of law when signed by the judge.

Copies of the complaint and final orders are available from the FTC’s website at http://www.ftc.gov and from the FTC’s Consumer Response Center, Room 130, 600 Pennsylvania Avenue, N.W., Washington, D.C. 20580. The FTC works for the consumer to prevent fraudulent, deceptive, and unfair business practices and to provide information to help spot, stop, and avoid them. To file a complaint in English or Spanish, click: http://www.ftc.gov/ftc/complaint.shtm or call 1-877-382-4357. The FTC enters Internet, telemarketing, identity theft, and other fraud-related complaints into Consumer Sentinel, a secure, online database available to more than 1,800 civil and criminal law enforcement agencies in the U.S. and abroad. For free information on a variety of consumer topics, click http://ftc.gov/bcp/consumer.shtm.

(FTC File No. 072-3245; Civ. No. 1-10-cv-2008)

(JAK Productions.final.wpd)

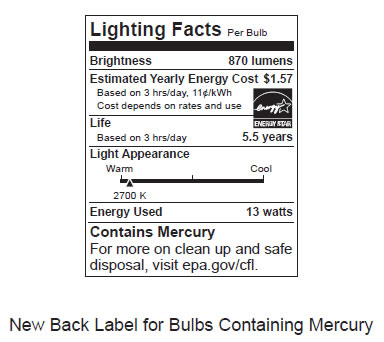

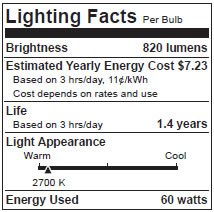

Under the new rule, the back of each package of light bulbs will have a “Lighting Facts” label modeled after the “Nutrition Facts” label that is currently on food packages. The Lighting Facts label will provide information about:

Under the new rule, the back of each package of light bulbs will have a “Lighting Facts” label modeled after the “Nutrition Facts” label that is currently on food packages. The Lighting Facts label will provide information about: