INTRODUCTION

Good morning. It is great to be here to speak on behalf of the U.S. Treasury. I would first like to thank the Federal Reserve Bank of New York for co-hosting the conference with us. They have put a lot of work into organizing an excellent event. The conference has become one of the key venues for Treasury to engage with the broader financial community, and I am glad to see so many senior market professionals and policy officials in the audience.

I would like to break my remarks today into two parts. The first will briefly cover a few of the Treasury Department’s broad priorities within domestic and international finance, including housing finance reform, CFIUS reform, digital taxation, and cryptocurrency. The second part will focus on our latest thinking on the market for U.S. Treasury securities.

A FEW BROAD PRIORITIES

To begin with Treasury’s priorities, we have taken significant steps in two key policy areas this month. On September 5th, we released our Housing Finance Reform Plan. Fannie Mae and Freddie Mac remain a critical part of the economy and have not been fully addressed since the financial crisis. The continued conservatorships give the FHFA far-reaching influence over a significant portion of the economy, and Treasury’s continued financial support leaves taxpayers exposed to future bailouts. Treasury is committed to reforms that will protect taxpayers, promote competition, and support affordable housing. Our plan includes nearly 50 recommended legislative and administrative reforms that are incremental, realistic, and balanced, and aim to preserve widespread and affordable access to the 30-year fixed-rate mortgage.

This month we also published new regulations relating to the Committee on Foreign Investment in the United States, which evaluates foreign investments for national security risks. Last year Congress passed a law enhancing CFIUS’s authorities, and the regulations published this month accompany that law. Without getting into too many details, we addressed issues like what types of personal data we worry about foreign entities acquiring, and the types of sales of real estate around sensitive sites that CFIUS should review. We encourage those interested in these issues to provide comments on our proposed regulations.

I would also like to emphasize that along with strengthening CFIUS, we have been running the review process more efficiently, to help ensure that safe investments can be made easily and expeditiously in the United States. The best proof of this is in the data. Treasury does not routinely release aggregate case data, but given CFIUS’s important role in protecting the United States’ longstanding open investment policy, the investment community should know that twice as many cases are clearing during the first stage of review as compared to a year ago. Where there are no national security risks, we are letting the parties know quickly, so that they can proceed with their transactions. The United States remains very much open to foreign investment.

Another area we are focused on is the international tax system. A few countries have adopted “digital taxes,” which impose tax on the revenue of digital business. These unilateral taxes fall disproportionately on U.S. firms and upset the long-standing multilateral approach to international taxation. We are actively engaging with the OECD on this issue. We are also conducting listening sessions with U.S. industry and other stakeholders to have the benefit of multiple perspectives. There is very strong bipartisan support to respond to unilateral efforts, and to seek a multilateral solution.

Cryptocurrency is a fourth topic that has our attention. Treasury welcomes responsible innovation in the financial sector, including new technologies that improve efficiency, expand access, and lower the cost of domestic and international payments. However, as evidenced by the statement released after the last G7 Finance Ministers meeting, cryptocurrencies have encountered significant skepticism because of the concerns they raise. I’d like to differentiate between two types of concerns: those the private sector can address, and those that government must consider.

Regarding the former, there is concern that cryptocurrency will be used to evade existing legal frameworks – like those governing taxation, anti-money laundering and countering the financing of terrorism. These frameworks apply to digital assets in no uncertain terms. Treasury’s Office of Foreign Assets Control has clarified that the obligation to comply with U.S. sanctions is the same regardless of whether a transaction is denominated in traditional fiat currency or digital currency. Treasury’s Financial Crimes Enforcement Network also issued further guidance and an advisory this year. There should be no doubt about the private sector’s compliance obligations.

But even if we are assured that the private sector is complying with existing legal requirements, there are important remaining concerns that government must consider. These include questions such as cryptocurrencies’ effects on financial stability, the monetary base, consumer protection, and privacy.

Internationally, Treasury and U.S. regulators are discussing these issues in the G7, the Financial Stability Board, and other forums. Domestically, the Financial Stability Oversight Council, or “FSOC,” which Secretary Mnuchin chairs, established a working group to take a cross-government look at these public policy issues. Digital currencies are not simply a means of payment, but, depending on their structure, can shift some functions traditionally performed by government to the private sector. Those engaged in digital currency markets should therefore expect that regulators, in pursuing the public interest, will take a very hard look at these issues.

TREASURY SECURITIES MARKET

Now let me turn in some detail to the Treasury market, where we finance the Federal government through more than $10 trillion of auctions a year. This conference was started five years ago in large part as a response to the flash rally and retracement that occurred in the Treasury market on October 15, 2014. It quickly became obvious that regulators were not able to sufficiently understand the event because they were missing comprehensive transaction data for the Treasury market.

Fortunately for Treasury, there was existing precedent for collecting fixed income transaction data. FINRA had been collecting data from its members through its Trade Reporting and Compliance Engine, or “TRACE,” in other fixed income markets for many years. Working with us and the SEC, FINRA agreed to also collect this data for Treasuries starting in 2017.

While the collection of the data was intended first and foremost to inform the official sector, there has also been great interest in the data from the private sector. Indeed, for other markets covered by TRACE, such as corporate bonds and mortgage-backed securities, select transaction data is publicly disseminated. Therefore, a natural question has been whether some form of Treasury transaction data will be publicly released as well.

Against this backdrop, Secretary Mnuchin spoke at this conference in 2017 and noted that any release of this data must be guided by the principle to “do no harm”.

Since the Secretary’s remarks, Treasury has sought to better understand the potential benefits of releasing transaction data to the public. We therefore gathered views from market participants through an extensive outreach effort over the course of 2018.

The typical motivation for making transaction data public in other fixed income securities has been the need for greater price transparency. However, based both on the feedback from market participants, and on the observation that Treasury securities already trade with very tight bid-offer spreads, price transparency largely exists in the Treasury market. It should therefore not be the sole basis for releasing transaction data.

However, while prices are transparent, our outreach confirmed that market volume data is not. I am pleased to announce today that Treasury has been working with FINRA to release aggregated data on Treasury volumes for public dissemination. The details are still being worked out, but our recommendation is for FINRA to release the data weekly, with the first publication early next year. We greatly appreciate the support of FINRA and the SEC in this endeavor, as well as feedback from our other official sector partners.

We believe the release of aggregate market volumes will be beneficial for three reasons:

- First, we think the market will find it very useful to understand how volumes fluctuate, whether as a result of seasonal flows or in response to significant events.

- Second, the data will ensure a more level playing field. Currently, market participants have access to various amounts of data, depending on what services they subscribe to and what parts of the market they operate in. The new release will allow all market participants to have access to the same comprehensive data.

- Third, the release of aggregate market volumes will be consistent with one of our key principles, in that it should have no negative impact on market behavior or liquidity. In fact, Treasury believes that a better understanding of how much volume is passing through the market, particularly in off-the-runs, should encourage even greater interest in those securities.

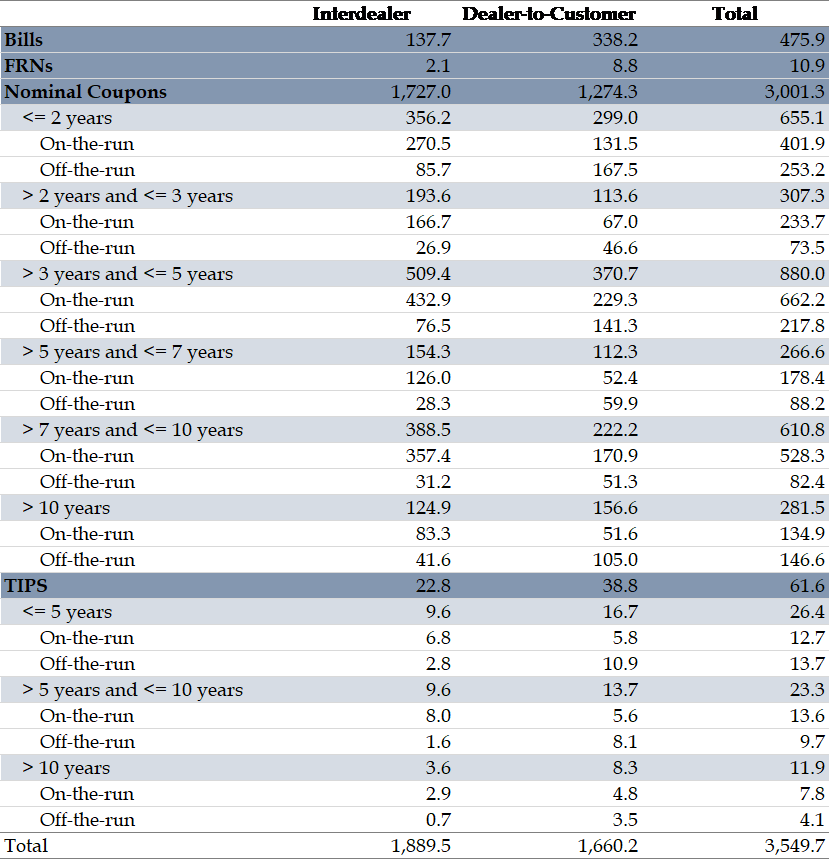

Slide 1 – Example Weekly Volumes

To make this more concrete, the first slide has a table with a sample of the information intended for public dissemination. As you can see, the data includes a breakdown between the two major venues where Treasury securities trade:

First, the interdealer market, which supports flows directly between dealers and all trading on interdealer broker (IDB) platforms, which includes principal trading firms (PTF)s.

Second, the dealer-to-customer (DtC) market, which is still the dominant place where dealers intermediate trades with customers, particularly in off-the-run securities.

Within each venue, the volumes will be further broken down into Treasury’s different security types and maturities, including on- versus off-the-run for coupons and TIPS.

Treasury Weekly Volumes

Week of August 30, 2019; $Billion

Notes

- This example includes actual data for trades from August 24th to August 30th.

- Interdealer includes dealer-to-dealer and trades executed on an Alternative Trading System (ATS).

- Dealer-to-Customer includes affiliate trades.

- STRIPS are included in Nominal Coupon and TIPS off-the-runs based on years-to-maturity.

- When issued trades through the end of the auction day are excluded.

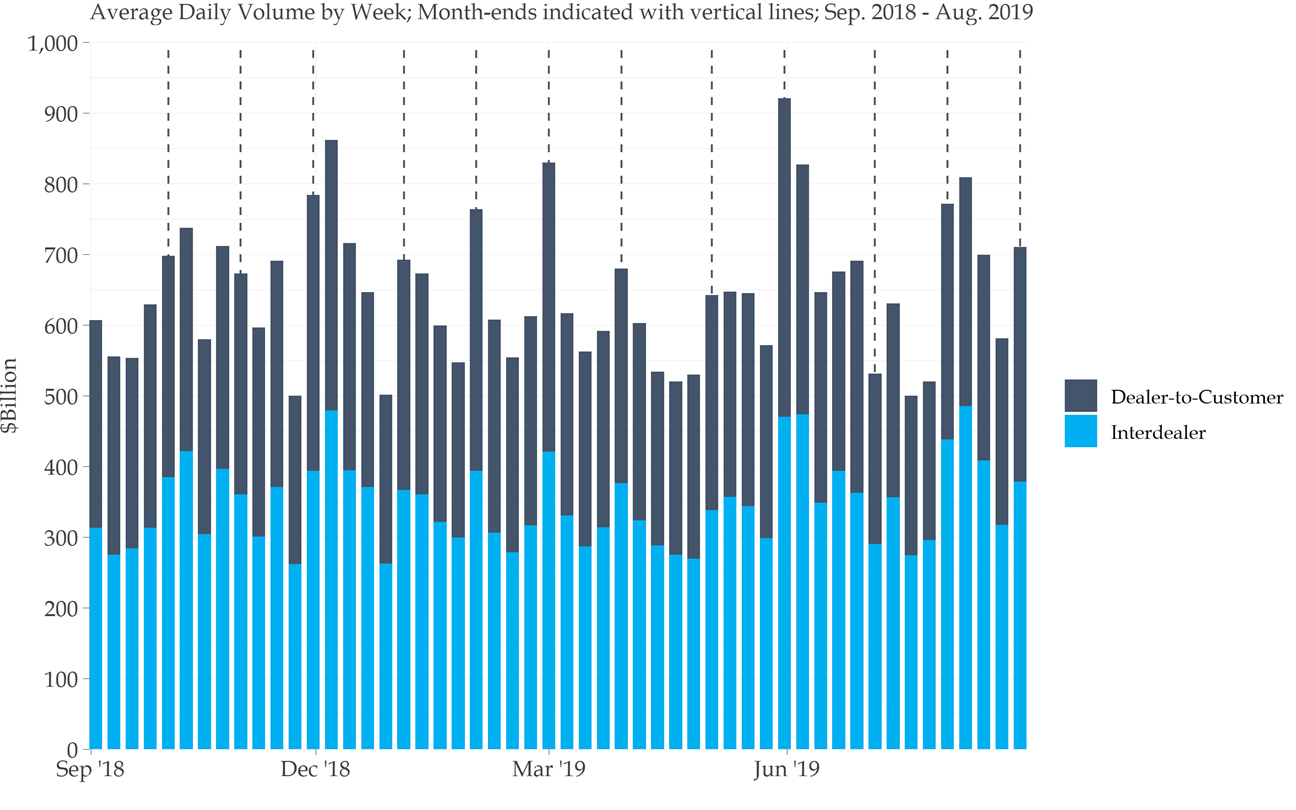

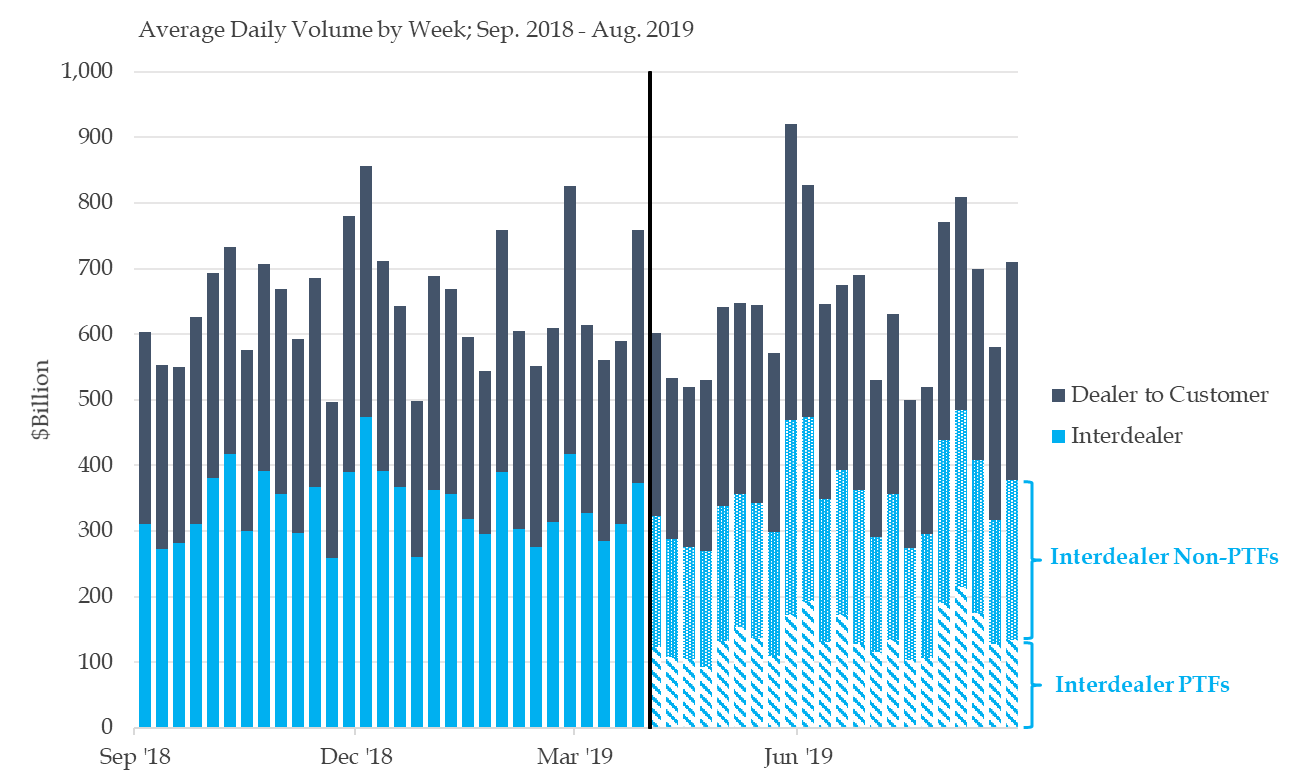

Slide 2 – All Securities by Venue

The next slide shows overall volumes by venue over the last 12 months, to give you a sense for how weekly reports can be combined over time to better understand market dynamics. There are a couple of interesting takeaways. First, average daily volumes ranged between roughly $500 billion and $1 trillion. Second, despite the significant focus in recent years on algorithmic trading and PTFs, it is important to remember how large and significant the more traditional DtC segment still is.

All Securities by Venue

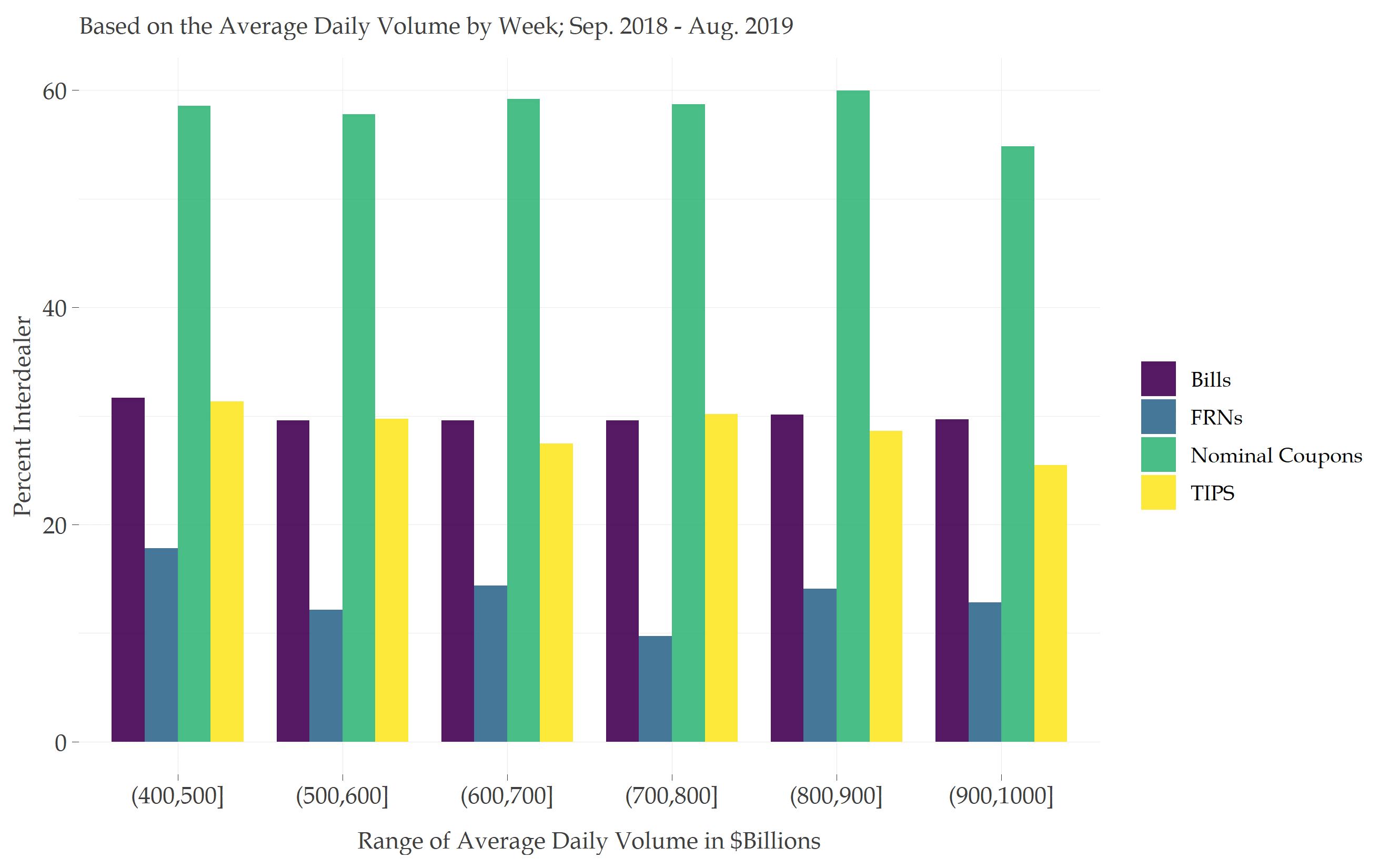

Slide 3 – Share of Volumes in the Interdealer Venue

Slide 3 looks at the relationship between security type, volume, and trading venue. The question we are trying to answer here is whether the composition of trading looks different for low-volume weeks compared to high-volume weeks. For instance, do low-volume weeks reflect a disproportionate pullback in the interdealer segment where PTFs trade, or in particular securities in that segment?

Generally speaking, what the data show is that the share of trading in the interdealer segment versus the DtC segment does not change dramatically as total volumes increase or decrease, and the same is true for the various types of securities traded. Based on a large sample of data, there seems to be a healthy stability to the market structure across volume levels.

Share of Volumes in the Interdealer Venue

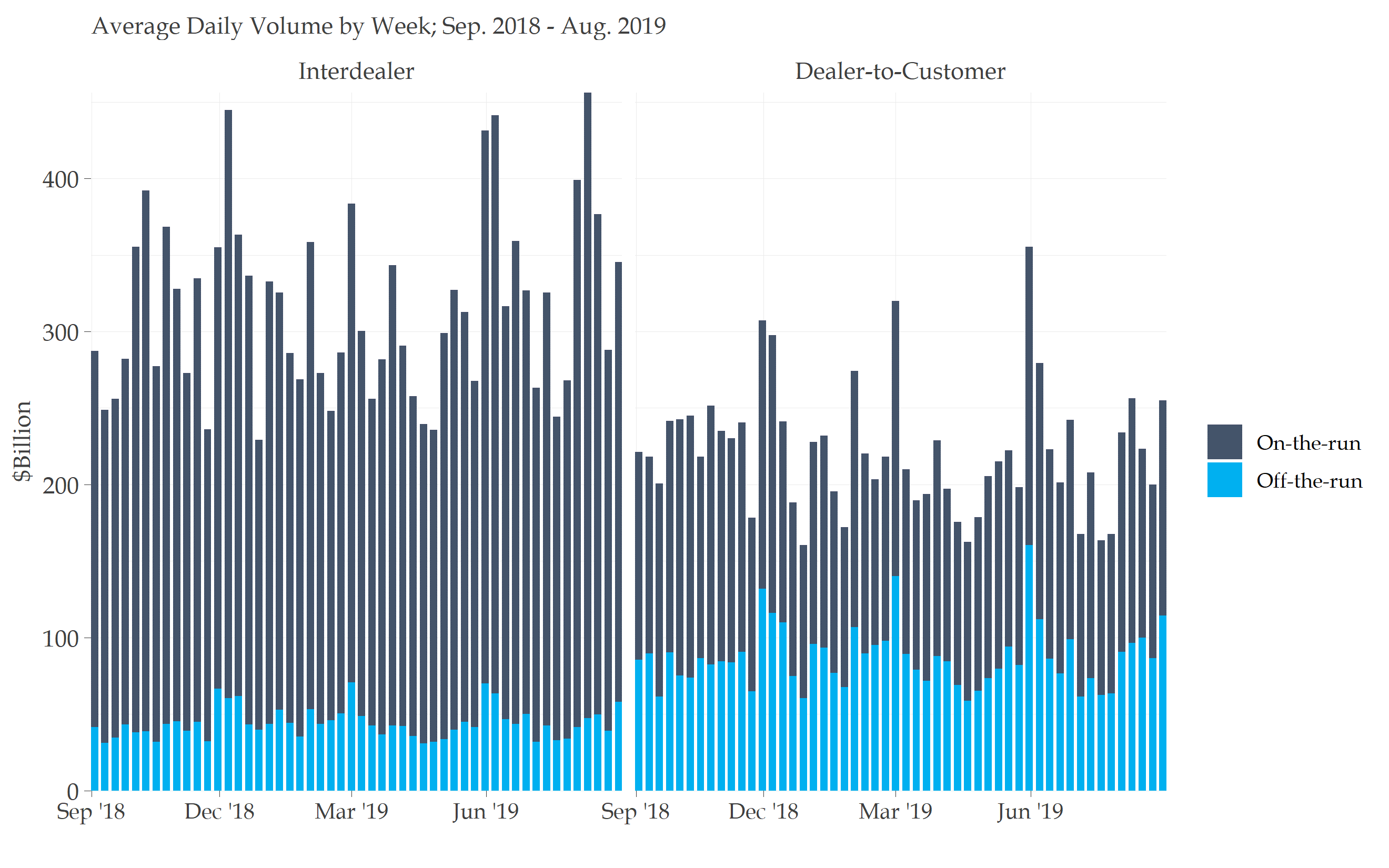

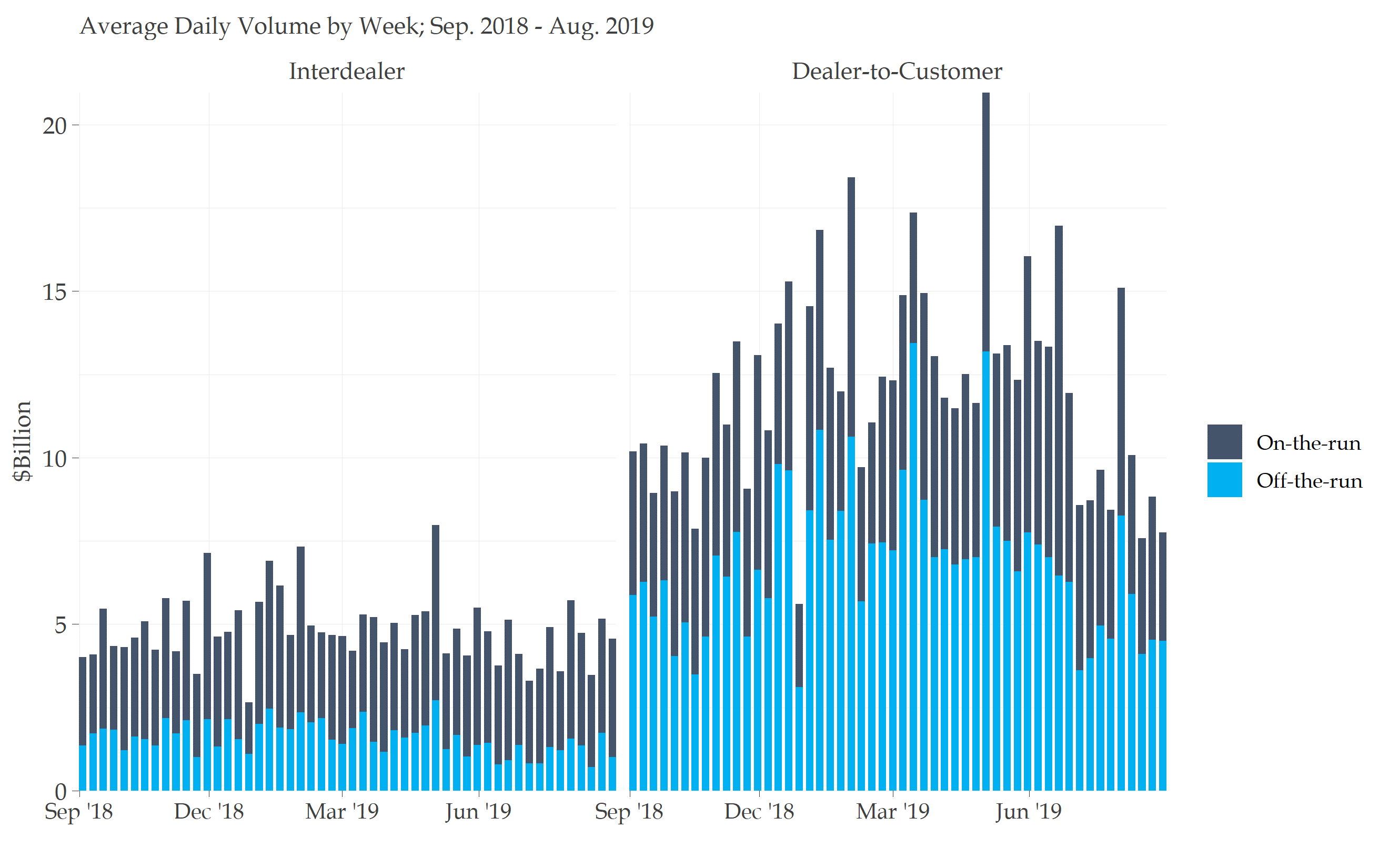

Slides 4 – 6 – Volumes by Security Type

The next few slides provide a closer look at volumes by security type and venue.

Slide 4 shows that coupon volumes are higher in the interdealer venue – an unsurprising result given the prevalence of electronic trading on IDBs, where on-the-run coupons trade in large volumes, at higher frequency, and in smaller trade sizes.

It also shows that volumes are more balanced between on-the-runs and off-the-runs in the DtC venue, with off-the-runs trading more heavily around quarter-ends. More generally, there is more trading in off-the-runs than expected by many we spoke to during our outreach efforts.

Nominal Coupon Volumes

Slide 5 shows that for TIPS, there is a far greater share of trading in the DtC venue, and that off-the-runs actually exceed on-the-runs in terms of volume.

TIPS Volumes

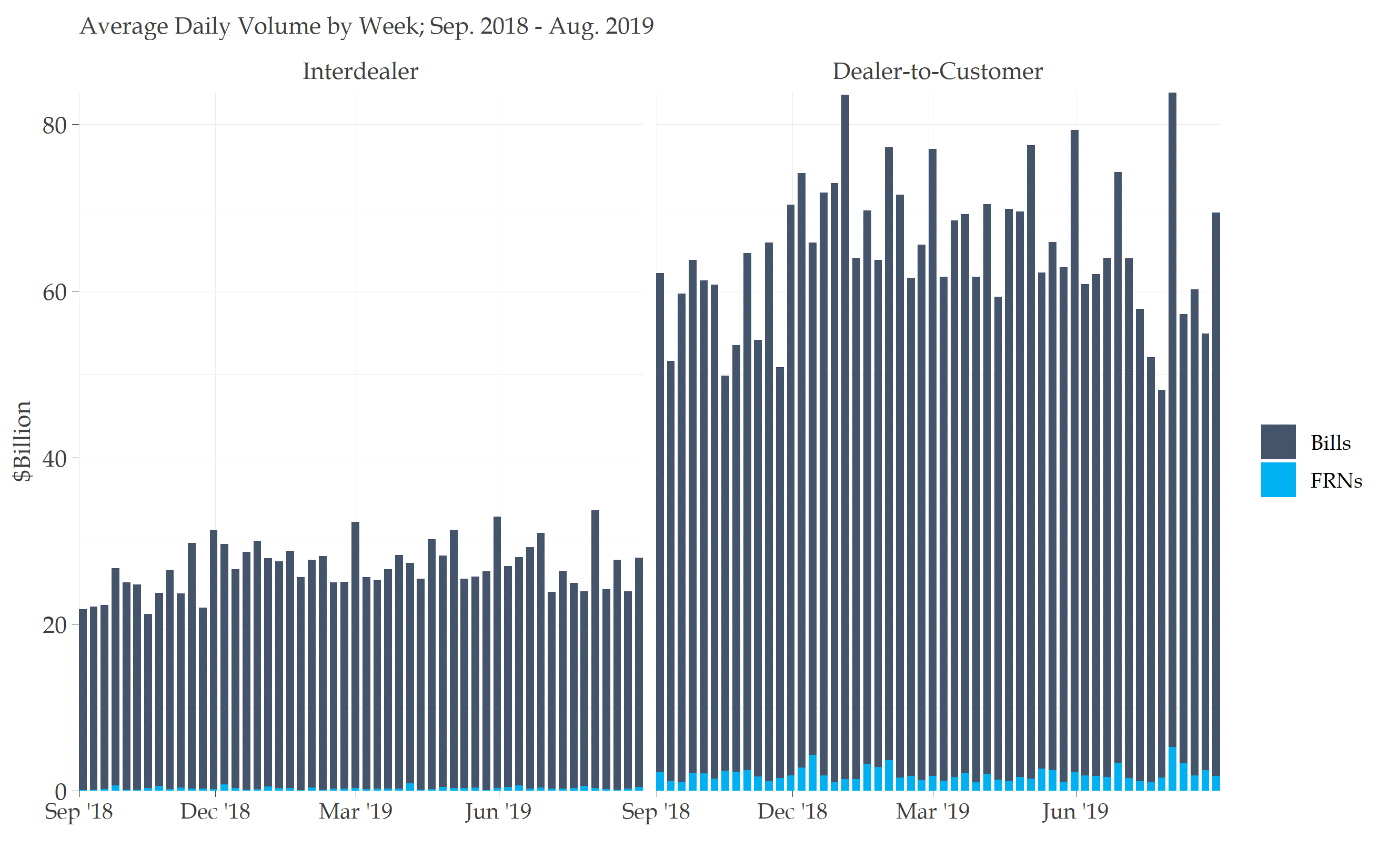

Slide 6 shows that bills and floating rate notes mostly trade in the DtC venue, and generally in larger transaction sizes. This is in part due to the prevalent use of these securities by the largest financial institutions for daily liquidity. The trend toward high frequency trading by PTFs that has been important in coupons has not had the same effect in these markets.

Bill and FRN Volumes

Treasury’s Analysis of Historical Data

All of the analysis shared so far is based on data that we plan to share with the public. In addition to this data, in April Treasury started collecting data for official sector use to better understand Principal Trading Firm activity. We have long known that PTFs represent a different type of participant in the Treasury market. For instance, they trade for their own account, do not have traditional customers, and typically employ algorithmic and high-frequency trading strategies. They also trade large total volumes, in small individual trade sizes, and generally do not hold sizable risk positions overnight.

To build a better understanding of PTF activity, FINRA made two enhancements to the Treasury transaction data it collects through TRACE.

The first was the collection of more detailed transaction reporting on IDB platforms in cases where a series of transactions occur in a brief trading session at a single price, which is often referred to as a “workup.” These brief sessions last just a few seconds and can result in hundreds of millions of dollars traded at a single price among numerous counterparties. Until the change was made, it was impossible to understand the exact timing and sequence of these trades. We knew who the buyers and sellers were, but we weren’t sure which buyers were matched with which sellers. The enhancement now allows us to match trades, bringing increased transparency to a previously opaque part of the market.

The other data enhancement was the requirement for large alternative trading systems (ATSs), which are the major IDB trading platforms, to identify the counterparty to every trade. Previously, ATSs only identified FINRA-members by name, with all other counterparties listed as a generic “customer.” PTFs, which are typically not FINRA-members, are now for the first time explicitly identified when trading on these platforms.

I would like to share a few findings from the internal analysis we have run using these data enhancements.

Slide 7 – PTF Volumes

Slide 7 shows an initial look at the PTF volumes. Starting in April 2019, PTF volumes are observed to average about $140 billion per day, or 20 percent of overall volumes. The relative share of PTF trading is fairly consistent across weeks and across fluctuations in overall volumes.

Volumes for Principal Trading Firms (PTF)

Note

- PTFs can be identified following an April 1 rule change by FINRA that requires large Alternative Trading Systems to identify all counterparties by name.

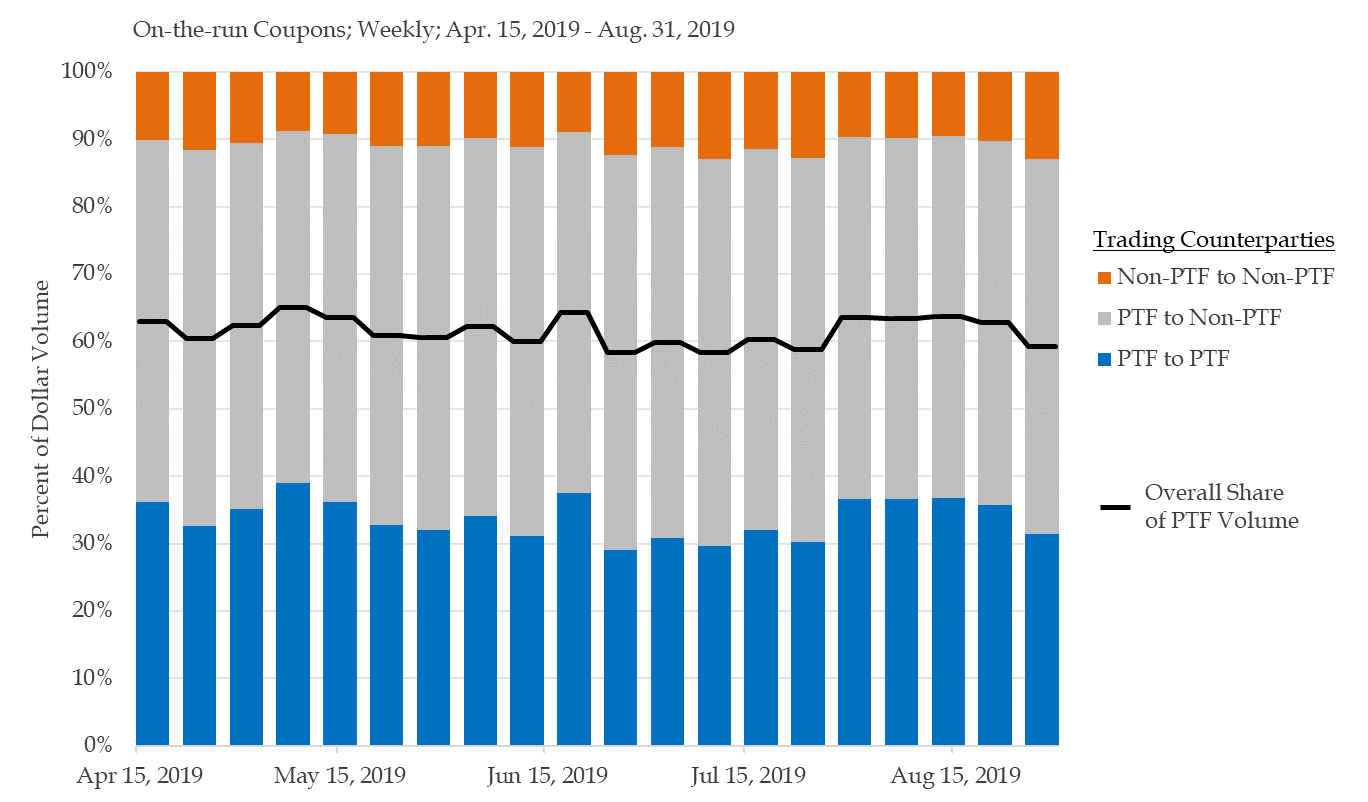

Slide 8 – Counterparties on Electronic IDB Platforms

Slide 8 narrows in on electronic IDB venues, where PTFs predominantly trade. This data shows PTFs account for around 60 percent of electronic IDB volumes.

The recent data enhancements allow us to break these volumes down based on whether the PTFs are trading with other PTFs or with dealers and other investment funds. One third of trading on electronic IDB platforms has only PTFs on both sides (as marked in blue). However, an additional 55 percent of trades are between PTFs and Non-PTFs (as marked in grey).

These findings suggest that PTFs are consistently providing liquidity at the top of the order book. They are therefore serving an important role in the price discovery process.

Counterparties on Electronic Interdealer Platforms

Note

- Non-PTF includes dealers and other investment funds.

CONCLUSION

To conclude, I again want to thank FINRA and our official sector partners, as well as all of the market participants, who provided valuable input during our outreach. Though we have not again had a flash rally of the magnitude of October 15, 2014, the new transaction data allows us to be better prepared to study one, should one occur, and to evaluate any potential response. Overall, the data confirms the robustness and resiliency of the Treasury market, which maintains exceptional liquidity, diverse participation, and remarkably efficient price discovery. There is plenty of opportunity for further inquiry, and we are glad that the private sector will have the opportunity to study the new data going forward. The Treasury market is of incredible importance to all of us, and we hope that this data will help bring additional understanding to the deepest and most liquid market in the world. Thank you.