The Federal Trade Commission has recovered more than $3 million that will be refunded to investors who were duped in an alleged scam that promoted video rental machines as a business opportunity.

The FTC’s law enforcement action against American Entertainment Distributors, Inc., was filed in 2005, naming 10 defendants. The U.S. District Court for the Southern District of Florida has now entered final orders against nine of them, prohibiting further illegal conduct and requiring payments for refunds. The FTC alleged that the defendants tricked investors into paying $28,000 to $37,500 apiece for video rental vending machines, telling them they could expect to earn between $60,000 and $80,000 a year, or recoup their initial investment in six to 14 months. The FTC’s case was halted for three years while the Department of Justice pursued parallel criminal proceedings.

The U.S. District Court for the Southern District of Florida has entered a permanent injunction against one defendant, approved settlements with five defendants, and entered default judgments against three other defendants:

- The court entered a permanent injunction against Russell G. MacArthur in July 2009. He is serving time in federal prison on related criminal charges. A judgment of more than $19 million was entered against him in the parallel criminal proceedings. The FTC has sued him for other business opportunity scams in the past.

- The court approved a settlement with defendant Miriam Andreoni on November 17, 2010. The order includes a judgment of $19.2 million, which is equal to the sum of the payments the American Entertainment Distributors operation took from consumers. Andreoni agreed to give up her rights in a litigation over the proceeds of her late husband’s life insurance policy. On December 30, 2010, the FTC obtained a judgment for $2 million in insurance proceeds in that case. She also agreed to forfeit $470,000 held by a shell corporation, and the court entered an order forfeiting these funds to a court-appointed receiver on January 25, 2011. The unpaid portion of the judgment is suspended because of her inability to pay. If she misrepresented her financial information, the FTC may seek payment of the full judgment. The settlement order also permanently bars her from making misleading statements when selling goods and services; from violating the FTC’s Franchise Rule or Business Opportunity Rule; and from selling, renting, leasing, transferring, or disclosing customer information.

- The court approved a settlement on November 17, 2010 with defendants Mauricio Paz and the now-defunct Universal Cybercom Corporation, which also includes a $19.2 million judgment. All but $116,617.95 was suspended based on the defendants’ inability to pay. If they misrepresented their financial information, the FTC may seek payment of the full judgment. Paz, who served time in federal prison on related criminal charges, is permanently barred from marketing business ventures or investment opportunities, and from making misrepresentations in marketing other goods or services.

- The court approved a settlement on November 17, 2010 with two other defunct corporations, Automated Entertainment Dispensers, Inc., and Universal Technical Support, Inc. These corporations will be dissolved by a court-appointed receiver, and their net assets, totaling more than $250,000, will be turned over to the FTC for consumer refunds.

- The court entered default judgments in February 2005 against defendants James MacArthur, American Entertainment Distributors, Inc., and American Entertainment Machines, Inc. More than $330,000 in assets have been recovered from these defendants. James MacArthur is serving time in federal prison on related criminal charges. A court-appointed receiver will pay the net assets from American Entertainment Distributors, Inc. and American Entertainment Machines, Inc. to the FTC for consumer refunds.

Litigation continues against the estate of the tenth defendant, Anthony Andreoni, who died in 2009. In addition, Miriam Andreoni has tried to withdraw from her settlement and has objected to awarding the insurance proceeds to the FTC. The district court rejected these efforts, and she is challenging those decisions in the federal court of appeals.

The FTC’s case against the American Entertainment Distributors, Inc. defendants was part of “Project Biz Opp Flop,” a 2005 FTC law enforcement sweep targeting business opportunity scams. The sweep included 16 FTC actions against more than 60 individual and corporate defendants who were charged with business opportunity and work-at-home fraud.

The Commission vote approving the proposed settlement order against Miriam Andreoni was 5-0. The January 2009 Commission vote approving the proposed settlement orders against Mauricio Paz; Universal Cybercom Corporation; Automated Entertainment Dispensers, Inc.; and Universal Technical Support, Inc. was 4-0.

Copies of the settlements and the court opinion concerning the life insurance proceeds are available on the FTC’s website.

NOTE: The consent decrees are for settlement purposes only and do not constitute admissions by the defendants that the law has been violated. Consent decrees have the force of law when approved and signed by the District Court judge.

The Federal Trade Commission works for consumers to prevent fraudulent, deceptive, and unfair business practices and to provide information to help spot, stop, and avoid them. To file a complaint in English or Spanish, visit the FTC’s online Complaint Assistant or call 1-877-FTC-HELP (1-877-382-4357). The FTC enters complaints into Consumer Sentinel, a secure, online database available to more than 1,800 civil and criminal law enforcement agencies in the U.S. and abroad. The FTC’s website provides free information on a variety of consumer topics.

(American Entertainment Distributors NR)

(FTC File No. X04-0082; Civ. Action No. 04-22431)

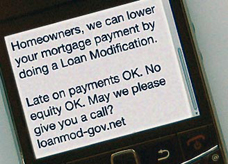

The Federal Trade Commission asked a federal judge to shut down an operation that allegedly blasted consumers with millions of illegal spam text messages, including many messages that deceptively advertised a mortgage modification website called “Loanmod-gov.net.” The FTC is asking the court to freeze the defendant’s assets.

The Federal Trade Commission asked a federal judge to shut down an operation that allegedly blasted consumers with millions of illegal spam text messages, including many messages that deceptively advertised a mortgage modification website called “Loanmod-gov.net.” The FTC is asking the court to freeze the defendant’s assets.