As part of its ongoing efforts to stop over-hyped health claims, the Federal Trade Commission has filed deceptive advertising charges against the marketers of the Ab Circle Pro – an abdominal exercise device – who promised consumers that exercising on the device for just three minutes a day would cause them to lose 10 pounds in two weeks. The defendants have agreed to settlements that provide as much as $25 million – and at least $15 million – depending on the volume of refunds consumers request.

Consumers who bought an Ab Circle Pro can submit a refund claim here.

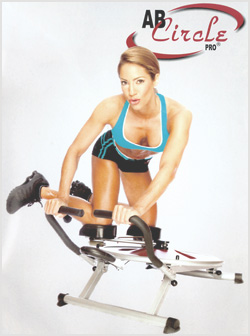

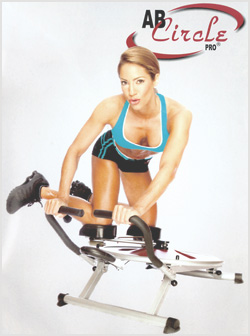

According to the FTC, in advertisements, the defendants promised that a three-minute workout on the Ab Circle Pro – a fiberglass disk with stationary handlebars and two knee rests that roll on the edge of the disk, allowing consumers to kneel and rotate side-to-side – was equivalent to doing 100 sit ups. In the infomercial, pitchwoman Jennifer Nicole Lee compared the Ab Circle Pro to a gym workout, saying, “You can either do 30 minutes of abs and cardio or just three minutes a day. The choice is yours.” The infomercial claimed that consumers using the Ab Circle Pro for three minutes a day would “melt inches and pounds,” and featured testimonialists claiming they had lost as much as sixty pounds. Consumers buying through the infomercial typically paid $200 to $250 for the device, while the price for those buying from retailers varied more widely.

According to the FTC, in advertisements, the defendants promised that a three-minute workout on the Ab Circle Pro – a fiberglass disk with stationary handlebars and two knee rests that roll on the edge of the disk, allowing consumers to kneel and rotate side-to-side – was equivalent to doing 100 sit ups. In the infomercial, pitchwoman Jennifer Nicole Lee compared the Ab Circle Pro to a gym workout, saying, “You can either do 30 minutes of abs and cardio or just three minutes a day. The choice is yours.” The infomercial claimed that consumers using the Ab Circle Pro for three minutes a day would “melt inches and pounds,” and featured testimonialists claiming they had lost as much as sixty pounds. Consumers buying through the infomercial typically paid $200 to $250 for the device, while the price for those buying from retailers varied more widely.

Said David Vladeck, Director of the FTC’s Bureau of Consumer Protection, “The FTC reminds marketers that they should think twice before promising a silver-bullet solution to a health problem – whether it involves losing weight or curing cancer. Weight loss is hard work, and telling consumers otherwise is deceptive.”

In addition to multiple versions of the infomercial – which aired more than 10,000 times between March 2009 and May 2010 – the defendants marketed the Ab Circle Pro online, in stores, in one- and two-minute television commercials, and in print advertisements.

The complaint names as defendants Fitness Brands, Inc., Fitness Brands International, Inc., and the two individuals who control them, Michael Casey and David Brodess; Direct Holdings Americas, Inc. and Direct Entertainment Media Group, Inc.; infomercial producer Tara Borakos and two companies she controls, Tara Productions Inc. and New U, Inc.; and Jennifer Nicole Lee and two companies she controls, JNL, Inc. and JNL Worldwide, Inc.

The complaint charges all the defendants except Lee and her companies with making false and/or unsupported claims, including that using the Ab Circle Pro caused rapid or substantial weight and fat loss; resulted in loss of weight, fat, or inches in specific parts of the body, such as the abdomen, hips, buttocks, and thighs; provided fat loss and weight loss equivalent to, or better than, a much longer gym workout; and provided the same rapid and substantial weight loss that people who provided testimonials for the infomercial said they experienced. The complaint also charges the Fitness Brands, Inc. defendants with providing the means to Direct Holdings Americas, Inc. and Direct Entertainment Media Group, Inc. to deceive consumers.

The complaint charges all the defendants with misrepresenting that using the Ab Circle Pro allowed Jennifer Nicole Lee to lose 80 pounds.

The complaint names Reader’s Digest Association, Inc. as a relief defendant, alleging that the company received proceeds of the deceptive advertising from its subsidiaries, Direct Holdings Americas and Direct Entertainment Media Group.

Under the settlements, Lee and the two companies she controls cannot misrepresent that the Ab Circle Pro, any substantially similar device, or any exercise equipment, food, drug, or device contributed to her weight loss. She also cannot endorse any exercise equipment, food, drug, or device unless the endorsement reflects her honest opinion or experience.

The settlements bar all defendants other than Lee and the two companies she controls from claiming that the Ab Circle Pro or any similar device is likely to cause rapid and substantial loss of weight, inches, or fat; is likely to do so in specific areas of the body such as the abdominal area, hips, thighs, and buttocks; or makes a significant contribution to an exercise plan that provides rapid and substantial loss of weight, inches, or fat. The defendants also are prohibited from claiming that the Ab Circle Pro or any similar device, if used for three minutes a day, causes users to lose 10 pounds in two weeks; provides the same exercise benefits as doing 100 sit-ups; or provides weight- or fat-loss benefits that are equivalent or superior to longer workouts on other exercise devices or gym equipment.

The settlements also prohibit all except the Lee defendants from making fat-, inch-, or weight-loss claims for any exercise equipment, food, drug, or device unless such claims are supported by competent and reliable scientific evidence. The defendants further cannot claim that consumers using such products can generally expect to achieve the results claimed by endorsers of the products, unless such claims are supported by competent and reliable evidence.

The settlements bar the Fitness Brands, Inc. defendants from providing others with the means to make any of the representations prohibited above.

Under the settlements, the Fitness Brands, Inc. defendants will pay $1.2 million. Direct Holdings Americas, Inc.; Direct Entertainment Media Group, Inc.; and relief defendant Reader’s Digest will pay $13.8 million – and up to $10 million more, depending on the volume of refund requests.

Consumers should carefully evaluate advertising claims for weight-loss products. For more information, see: Weight Loss & Fitness.

The Commission vote authorizing the staff to file the complaint and approving the proposed consent decree was 5-0. The complaint was filed in the U.S. District Court for the Southern District of Florida on August 22, 2012.

NOTE: The Commission files a complaint when it has “reason to believe” that the law has been or is being violated and it appears to the Commission that a proceeding is in the public interest. The complaint is not a finding or ruling that the defendant has actually violated the law. The consent order is for settlement purposes only and does not constitute an admission by the defendant that the law has been violated. Consent orders have the force of law when approved and signed by the District Court judge.

The Federal Trade Commission works for consumers to prevent fraudulent, deceptive, and unfair business practices and to provide information to help spot, stop, and avoid them. To file a complaint in English or Spanish, visit the FTC’s online Complaint Assistant or call 1-877-FTC-HELP (1-877-382-4357). The FTC enters complaints into Consumer Sentinel, a secure, online database available to more than 2,000 civil and criminal law enforcement agencies in the U.S. and abroad. The FTC’s website provides free information on a variety of consumer topics. Like the FTC on Facebook, follow us on Twitter, and subscribe to press releases for the latest FTC news and resources.

(FTC File No. 1023047)

According to the FTC, in advertisements, the defendants promised that a three-minute workout on the Ab Circle Pro – a fiberglass disk with stationary handlebars and two knee rests that roll on the edge of the disk, allowing consumers to kneel and rotate side-to-side – was equivalent to doing 100 sit ups. In the infomercial, pitchwoman Jennifer Nicole Lee compared the Ab Circle Pro to a gym workout, saying, “You can either do 30 minutes of abs and cardio or just three minutes a day. The choice is yours.” The infomercial claimed that consumers using the Ab Circle Pro for three minutes a day would “melt inches and pounds,” and featured testimonialists claiming they had lost as much as sixty pounds. Consumers buying through the infomercial typically paid $200 to $250 for the device, while the price for those buying from retailers varied more widely.

According to the FTC, in advertisements, the defendants promised that a three-minute workout on the Ab Circle Pro – a fiberglass disk with stationary handlebars and two knee rests that roll on the edge of the disk, allowing consumers to kneel and rotate side-to-side – was equivalent to doing 100 sit ups. In the infomercial, pitchwoman Jennifer Nicole Lee compared the Ab Circle Pro to a gym workout, saying, “You can either do 30 minutes of abs and cardio or just three minutes a day. The choice is yours.” The infomercial claimed that consumers using the Ab Circle Pro for three minutes a day would “melt inches and pounds,” and featured testimonialists claiming they had lost as much as sixty pounds. Consumers buying through the infomercial typically paid $200 to $250 for the device, while the price for those buying from retailers varied more widely.