A Federal Trade Commission undercover shopper survey found that video game retailers continue to enforce age-based ratings, while movie theaters have made marked improvement in box office enforcement.

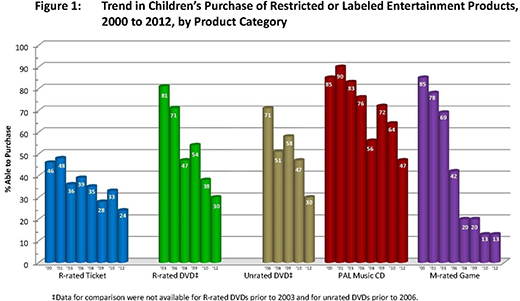

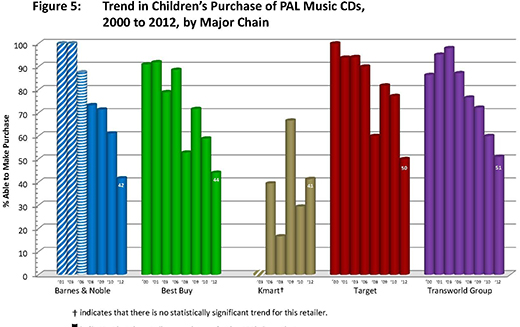

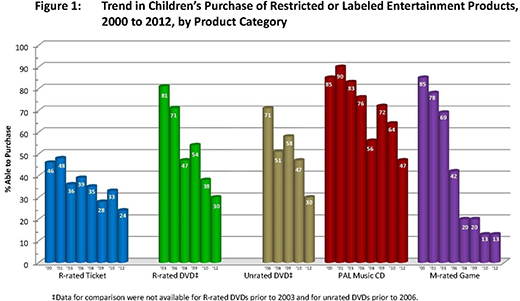

Only 13 percent of underage shoppers were able to purchase M-rated video games, while a historic low of 24 percent were able to purchase tickets to R-rated movies. In addition, for the first time since the FTC began its mystery shop program in 2000, music CD retailers turned away more than half of the undercover shoppers. Movie DVD retailers also demonstrated steady improvement, permitting less than one-third of child shoppers to purchase R-rated DVDs and unrated DVDs of movies that had been rated R for theaters. (See Figure 1).

“Our underage shopper survey shows continued progress in reducing sales,” said Charles Harwood, Acting Director of the FTC’s Bureau of Consumer Protection. “But retailers can still strengthen their commitment to limit children’s access to products that are rated or labeled as potentially inappropriate for them.”

The FTC arranged for 13- to 16-year-olds, unaccompanied by a parent, to attempt to buy R-rated movie tickets; R-rated DVDs; unrated DVDs that were R-rated when first released in theaters; music CDs carrying a Parental Advisory Label (PAL) that warns of explicit content; and video games rated “M,” which means they may be suitable for persons age 17 and older. Between April and June 2012, the teenagers attempted to buy these products, which are rated or labeled by self-regulatory bodies of the entertainment industry, from national and regional chain stores and theaters across the United States.

- Movie tickets. Ratings enforcement at the movie box office is at its highest level since the FTC began its mystery shopper program in 2000. Less than one-quarter of underage shoppers were able to buy a ticket to an R-rated movie, down from one-third in 2010.

- Movie DVDs. Retailers of R-rated and unrated DVDs continued their trend toward increased ratings enforcement. Thirty percent of shoppers were able to purchase R-rated DVDs compared to 38 percent in 2010, and 30 percent were able to buy unrated DVDs, down from 47 percent in 2010.

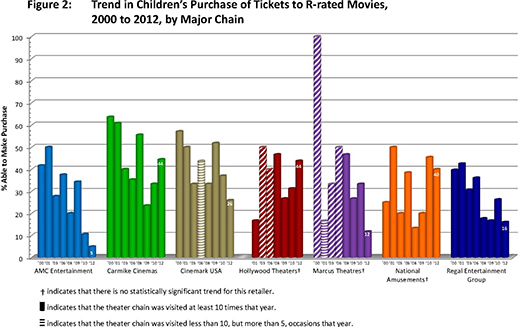

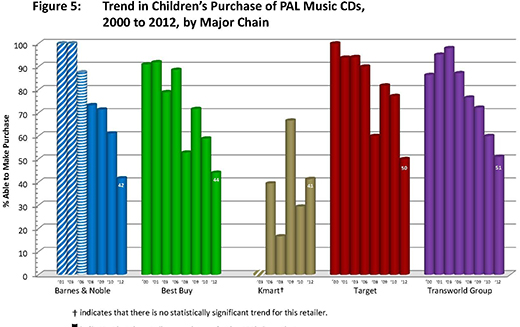

- Music CDs. Retailers of explicit-content music are increasingly turning away children attempting to purchase music CDs bearing the Parental Advisory Label. Less than half of underage shoppers (47 percent) were able to purchase CDs with this label, down from 64 percent in 2010 and 72 percent in 2009.

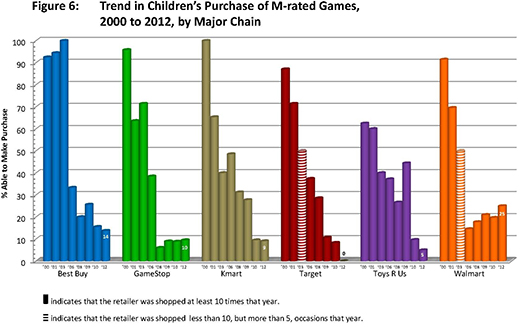

- Video games. Unchanged from 2010, 13 percent of underage teenage shoppers were able to buy M-rated video games – the highest level of compliance among the industries.

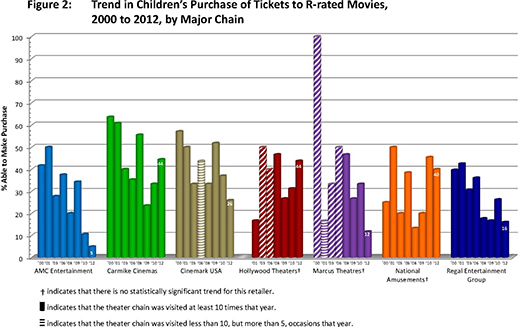

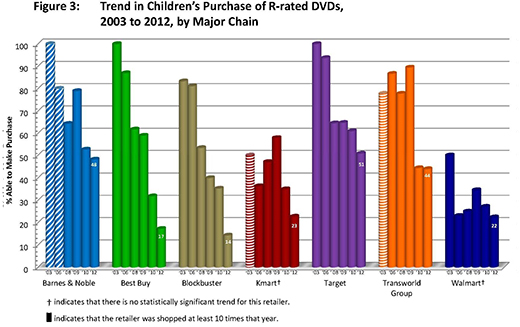

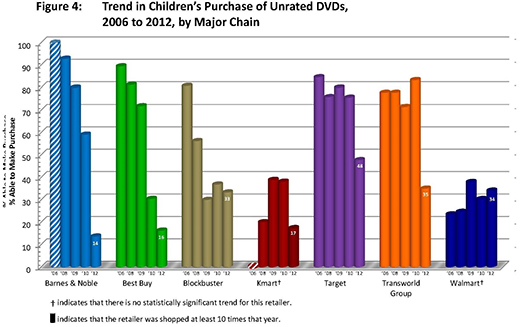

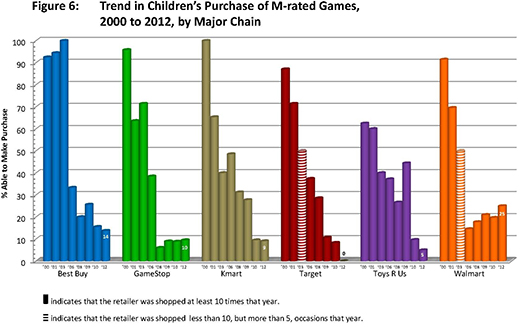

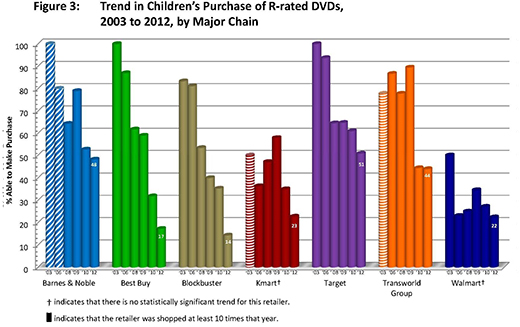

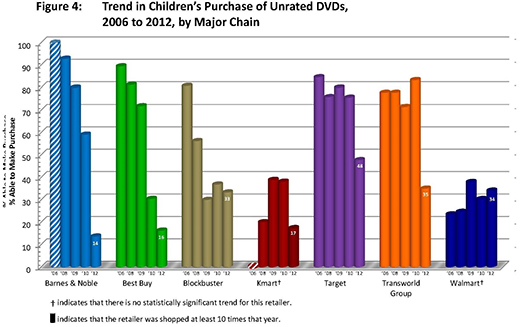

Figures 2 through 6 below depict historical survey results for each product category, broken out by major theater chain or retailer.

According to Figure 2, four of the seven major theater chains have demonstrated a statistically significant trend toward increased enforcement of the R-rating at the box office since 2000. In the most recent survey, AMC Entertainment, Regal Entertainment Group, and Marcus Theatres demonstrated the highest level of enforcement. AMC turned away 95 percent of child shoppers trying to buy tickets to an R-rated movie.

Figure 3 shows that, since 2003, five of the seven major retailers have demonstrated a statistically significant trend toward restricting the sale of R-rated DVDs to underage shoppers. In the most recent survey, Blockbuster, Best Buy, Walmart, and Kmart denied more than three quarters of purchase attempts.

Figure 4 shows that, since 2006, the same five major retailers from the R-rated DVD category have demonstrated a statistically significant trend toward restricting the sale of unrated DVDs based on films rated R for theaters. In addition, Barnes & Noble, Best Buy, and Kmart refused to sell unrated DVDs to more than eight of ten underage shoppers. Also, two retailers – Barnes & Noble and Walmart – demonstrated markedly different enforcement levels for unrated DVDs compared to R-rated DVDs: Whereas Barnes & Noble permitted 48 percent of underage shoppers to buy R-rated DVDs, it allowed only 14 percent to purchase unrated DVDs. In contrast, Walmart permitted 22 percent of R-rated DVD purchases, but 33 percent of unrated DVD purchases.

As shown in Figure 5, four of the five major retail chains have demonstrated a statistically significant trend toward restricting the sale of Parental Advisory Label music to child shoppers since 2000. In the most recent survey, all of the retailers denied sales to half or more of the undercover shoppers.

Finally, Figure 6 demonstrates the significant improvement since 2000 in retail enforcement of the Mature rating for packaged video games. Four of the six major game retailers refused to sell M-rated games to 90 percent or more of the underage shoppers. Target registered an impressive 100 percent enforcement rate for all 37 undercover shops, the first time a major retailer has accomplished this feat in any category when shopped on more than ten occasions. However, Target’s enforcement record on R-rated DVDs which, like M-rated games are rated as appropriate for ages 17 and up, was not as impressive. As shown in Figure 3, Target permitted 51 percent of underage shoppers to purchase R-rated DVDs.

Since 2000, when the FTC issued its first report to Congress on marketing violent entertainment to children, the agency has called on the entertainment industry to be more vigilant in three areas: restricting the marketing of mature-rated products to children; clearly and prominently disclosing rating information; and restricting children’s access to mature-rated products at retail. The last report to Congress was published in 2009.

Parents can learn more about how entertainment media for children are rated here. This site describes the different ratings systems, and provides links to the organizations that sponsor them.

The Federal Trade Commission works for consumers to prevent fraudulent, deceptive, and unfair business practices and to provide information to help spot, stop, and avoid them. To file a complaint in English or Spanish, visit the FTC’s online Complaint Assistant or call 1-877-FTC-HELP (1-877-382-4357). The FTC enters complaints into Consumer Sentinel, a secure, online database available to more than 2,000 civil and criminal law enforcement agencies in the U.S. and abroad. The FTC’s website provides free information on a variety of consumer topics. Like the FTC on Facebook, follow us on Twitter, and subscribe to press releases for the latest FTC news and resources.