News Release 2020-99 | July 31, 2020 Share This Page: WASHINGTON, D.C.—Acting Comptroller of the Currency Brian P. Brooks issued the following statement after presenting Varo Bank, N.A. its official charter: It is a great honor to present Varo Bank its full-service national bank charter. For more than 157 years, national bank charters have signified to […]

Monthly Archives: July 2020

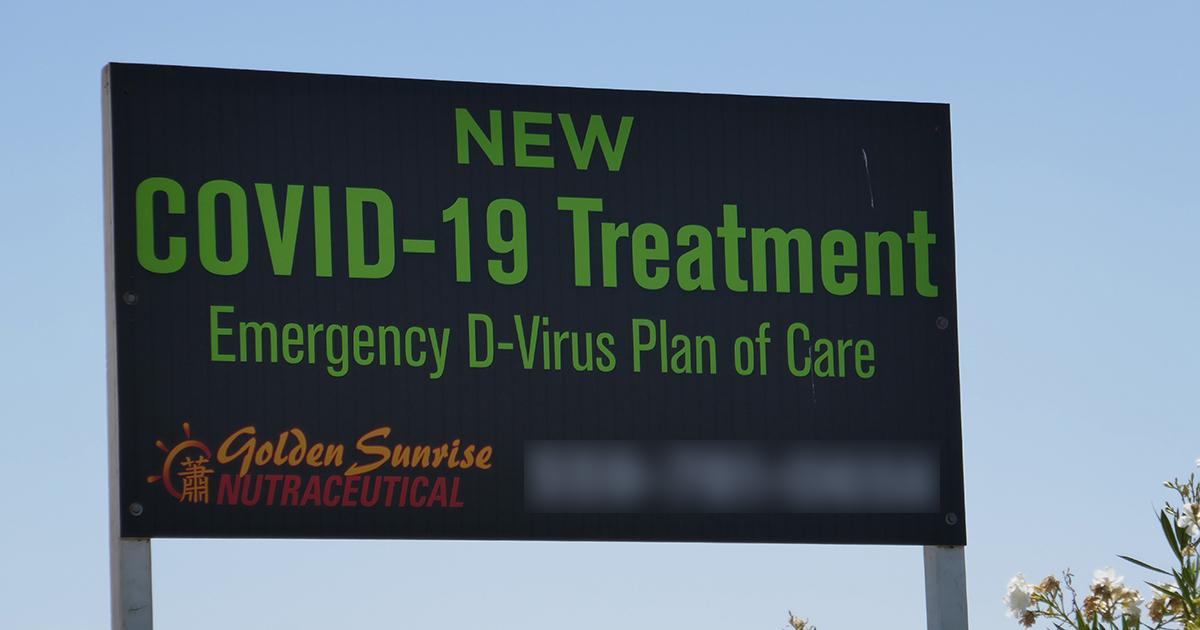

FTC Sues California Marketer of $23,000 COVID-19 “Treatment” Plan

The Federal Trade Commission charged a California-based company called Golden Sunrise Nutraceutical, Inc. with deceptively advertising a $23,000 treatment plan as a scientifically proven way to treat COVID-19, the disease caused by coronavirus. According to the FTC’s complaint, Golden Sunrise began marketing its Emergency D-Virus plan as a treatment for COVID-19 in March 2020. Advertising […]

Treasury Sanctions Chinese Entity and Officials Pursuant to Global Magnitsky Human Rights Executive Order

Washington – Today, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) sanctioned one Chinese government entity and two current or former government officials in connection with serious rights abuses against ethnic minorities in the Xinjiang Uyghur Autonomous Region (XUAR). These designations include the Xinjiang Production and Construction Corps (XPCC), Sun Jinlong, […]

FTC Announces Staff Reports on Car Buying and Financing Experience, Results of Auto Buyers Study

Two new staff reports from the Federal Trade Commission highlight some of the challenges and confusion consumers can face in buying and financing a car, particularly relating to charges for add-on items after the initial price negotiation that can lead to them paying more than expected. The reports are based, in part, on a study […]

IRS grants additional relief for rehabilitation credit deadlines

IR-2020-173, July 30, 2020 WASHINGTON — Because of the burdens the COVID-19 pandemic has placed on taxpayers claiming the rehabilitation credit, the Internal Revenue Service today issued Notice 2020-58 (PDF) that provides additional relief to taxpayers in satisfying the substantial rehabilitation test. Projects must satisfy the “substantial rehabilitation test” within a 24- or 60-month period […]

IRS issues proposed regulations for TCJA’s simplified tax accounting rules for small businesses

IR-2020-174, July 30, 2020 WASHINGTON — The Internal Revenue Service today issued proposed regulations (PDF) updating various tax accounting regulations to adopt the simplified tax accounting rules for small businesses under the Tax Cuts and Jobs Act (TCJA). For tax years beginning in 2019 and 2020, these simplified tax accounting rules apply for taxpayers having […]

FTC Acts to Stop Deceptive Insulation and Energy-Savings Claims

The Federal Trade Commission sued four companies that sell paint products used to coat buildings and homes, alleging that they deceived consumers about their products’ insulation and energy-savings capabilities. In complaints filed in federal court, the FTC charged that the companies falsely overstated the R-value ratings of the coatings, making deceptive statements about heat flow […]

Treasury and United States Postal Service Reach Agreement on Terms of CARES Act Loan

WASHINGTON – Today the U.S. Department of the Treasury announced that it had reached an agreement with the United States Postal Service (USPS) on the material terms and conditions of a loan of up to $10 billion to the USPS under Section 6001 of the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The loan […]

Treasury Continues to Pressure Investors and Companies Supporting the Assad Regime’s Corrupt Reconstruction Efforts

Washington – Today, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) sanctioned one individual and nine entities for enriching the Syrian regime through construction of luxury real estate. This action is the Treasury Department’s second sanctions action pursuant to the Caesar Syria Civilian Protection Act of 2019 (Caesar Act). OFAC previously […]

IRS: New law provides relief for eligible taxpayers who need funds from IRAs and other retirement plans

IR-2020-172, July 29, 2020 WASHINGTON — The Internal Revenue Service provided a reminder today that the Coronavirus Aid, Relief, and Economic Security (CARES) Act can help eligible taxpayers in need by providing favorable tax treatment for withdrawals from retirement plans and IRAs and allowing certain retirement plans to offer expanded loan options. Can I get […]