Board Action Bulletin

NCUA adopts 2011 budget of $225.4 million

The NCUA Board approved a 2011 operating budget of $225.4 million. The budget increased by $24.5 million or 12 percent over 2010. It includes 78 additional staff positions and accommodates program adjustments to ensure the successful execution of the agency’s safety and soundness mission.

The most significant increase in personnel relates to the annual examination program, which was started in 2010. This program adds 60 field positions to the regions and incorporates more frequent onsite contact for all federal credit unions. Increased examiner resources are required for examination of every federal credit union every year, and problem code credit unions are more closely monitored.

The $24.5 million increase is split between baseline changes and program changes. Baseline changes, which total $14.3 million, represent funds needed to maintain the agency’s current level of services. Program changes, which total $10.2 million, represent program initiatives. An approved $2.5 million capital budget includes $1.3 million primarily for maintaining information systems and $1.2 million for ongoing renovation to the agency’s 18-year old headquarters.

Chairman Debbie Matz mentioned during the budget discussion that current Office of Small Credit Union Initiatives Director Tawana Y. James has been selected to lead the new Office of Minorities and Women Inclusion (OMWI) effective January 21, 2011. The agency’s new OMWI was created by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010.

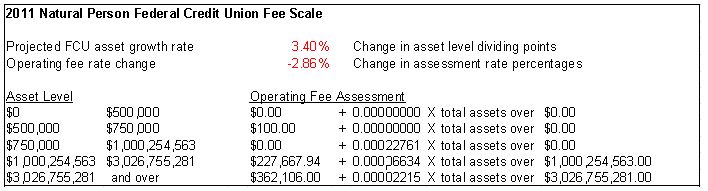

FCU operating fee scale declines 2.86 percent

The NCUA Board reduced the 2011 natural person federal credit union operating fee by 2.86 percent while maintaining Operating Fund cash reserves and contingency funds based on predicted NCUA operating costs.

Assets of natural person federal credit unions are predicted to increase approximately 3.40 percent during 2010; thus, the asset level dividing points for the 2011 operating fee scale is increased by 3.4 percent. Operating fees are due by Friday, April 15, 2011.

Overhead transfer rate set

The NCUA Board approved a 58.9 percent overhead transfer rate (OTR) for 2011 based on federal and state examination and supervision workload, staff time spent on insurance related duties, and the increased cost of NCUA resources and programs.

The National Credit Union Share Insurance Fund (NCUSIF) covers agency expenses associated with insurance-related functions of NCUA operations. In addition to federal credit union operating fees, the OTR is a funding source for the NCUA budget; however, it does not affect the amount of the budget, which the Board approves separately. The OTR is applied to actual expenses incurred each month.

The method used to calculate the OTR, which is detailed in the Board Action Memorandum, was evaluated by an independent, expert firm. Initial draft reports indicate NCUA’s OTR methodology is equitable and has no material weaknesses.

Interim rule addresses technical corrections

The NCUA Board approved an interim final rule that includes three technical corrections to clarify the intent of the new, Part 704, corporate credit union rule published in the Federal Register in October.

The interim rule revises the definition of collateralized debt obligation, investments now prohibited for corporate credit unions. The revised definition excludes the following types of permissible investments – commercial mortgage-backed securities, securities fully guaranteed by the U.S. government or government-sponsored enterprises, and securities collateralized by government guaranteed securities.

The interim rule also corrects the list of investments exempt from single obligor limits and credit rating requirements in §704.6; and it corrects Model Form “H” instructions, clarifying that the form is only for use on or after October 20, 2011. Effective January 18, 2011, the interim final rule was issued with a 30-day comment period.

Corporate amendments proposed

The NCUA Board issued proposed amendments to Part 704 as a follow-on rulemaking to the recently approved final rule on corporate credit unions (corporates). The proposals would require corporates to establish new internal control reporting requirements and establish an enterprise-wide risk management committee staffed with a risk management expert, conduct all board of director votes as recorded votes, and disclose certain CUSO compensation received by employees who are dual employees of corporates and corporate CUSOs. The proposed amendments also provide for the equitable sharing of Temporary Corporate Credit Union Stabilization Fund expenses among all members of a corporate and permit a corporate to charge reasonable one-time or periodic membership fees. In addition, the proposal would amend 12 C.F.R. Parts 701 and 741 to limit natural person credit unions to membership in one corporate at a time.

The amendments were issued with a 30-day comment period, and a final is expected in early 2011.

NCUSIF, TCCUSF reports

The National Credit Union Share Insurance Fund (NCUSIF) equity ratio was reported at 1.29 percent as of October 31, 2010. The increase from the September 30, 2010, equity ratio of 1.18 percent was due to invoicing the semi-annual capitalization deposit adjustment and the 0.1242 percent premium assessment, which are due November 22, 2010.

Year-to-date, the fund is reporting net income of $323.5 million. Through October, the fund recorded $694.4 million in insurance loss expense, bringing the month-end reserve balance to $1.21 billion.

At October 31, 2010, 378 federally insured credit unions, with assets of $44.4 billion, and shares of $39.1 billion, were designated as CAMEL codes 4 or 5. Additionally, there were 1,774 CAMEL 3 credit unions with assets of $160.3 billion and shares of $141.4 billion. Nearly 23 percent of all assets are in CAMEL code 3, 4 or 5 credit unions.

Through October, 27 federally insured credit unions have failed in 2010 — 17 liquidations and 10 assisted mergers.

The Temporary Corporate Credit Union Stabilization Fund reported a total liabilities and net position of $4.37 billion, up from $370 million reported as of September 30, 2010. The change reflects the $4 billion borrowed from the U. S. Treasury and loaned to Western Bridge Corporate Federal Credit Union. The Stabilization Fund also reported revenue of $554,000.

Financial data reported for both the Share Insurance Fund and the Temporary Corporate Stabilization Fund are preliminary and unaudited.

Assessment predictions in 2011

A combined NCUSIF premium and Stabilization Fund assessment are projected to range between 20 and 35 basis points and cost between $1.5 and $2.7 billion in 2011.

The NCUSIF premium is based on variables that include insured share growth, investment income, insurance loss expense and the NCUSIF equity level. The Stabilization Fund considers borrowed funds, cash flows and affordability.

The NCUA tweets all open Board meetings live. Follow @TheNCUA (opens new window) on Twitter, and access Board Action Memorandums and NCUA rule changes at www.ncua.gov. The NCUA also live streams, archives and posts videos of open Board meetings online.