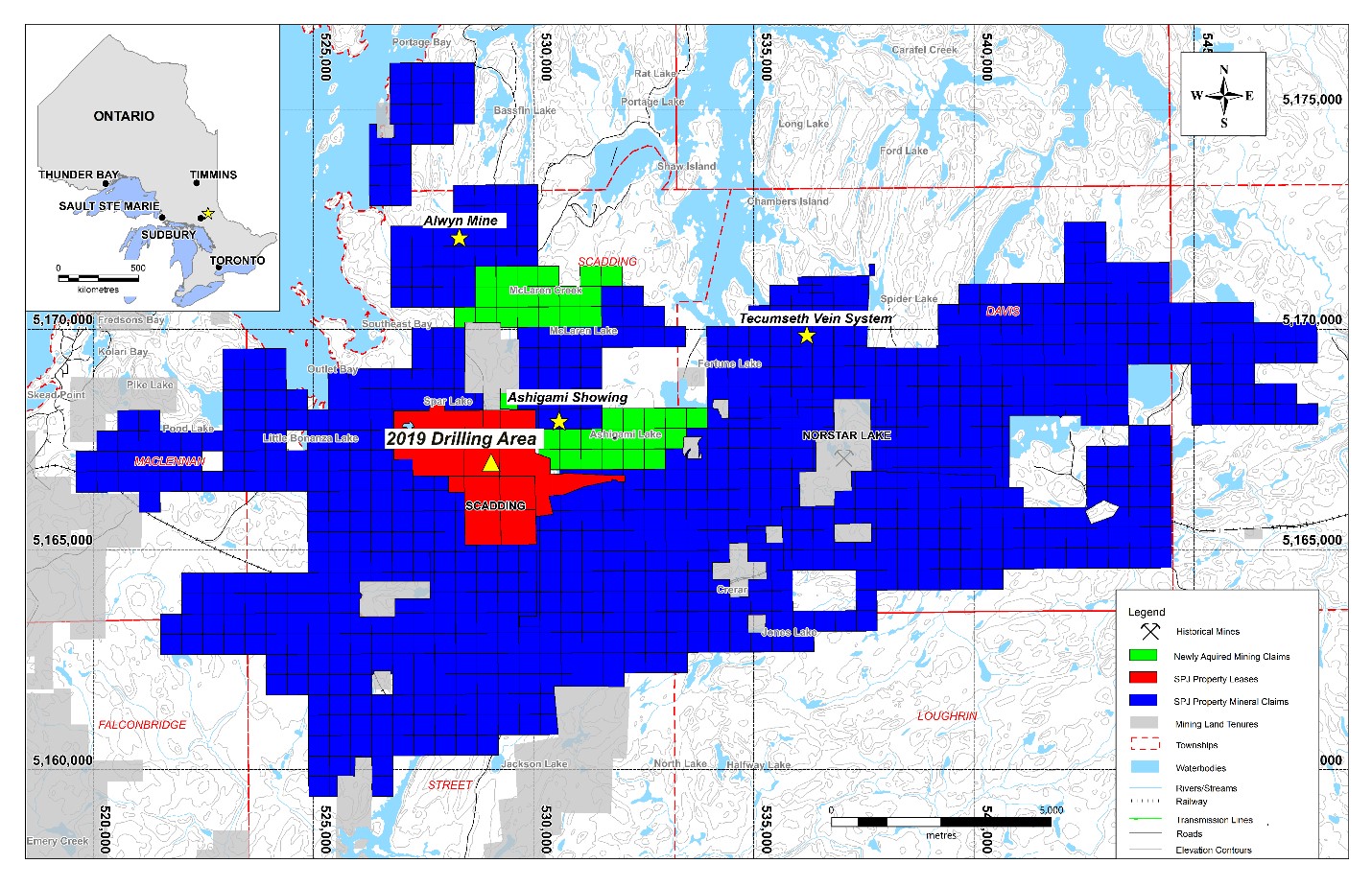

TORONTO, Oct. 04, 2019 (GLOBE NEWSWIRE) — MacDonald Mines Exploration Ltd. (TSX-V: BMK) (“MacDonald Mines”, “MacDonald” or the “Company”) announces that is has purchased 100% interest in 38 claims, located 35 kilometres from downtown Sudbury, Ontario. The new claims add to MacDonald’s large SPJ Property package and cover prospective extensions of the potential Iron-Oxide-Copper-Gold (“IOCG”) system identified at the Scadding Mine (Figure 1). The Scadding Mine produced 914 kilograms of gold from 127,000 tonnes of mineralized material grading 7.2 g/t (OFR 5771) and the large land package surrounding the mine has also yielded multiple discovery areas to explore – including significant showings of copper, cobalt, nickel and silver in addition to high-grade gold.

MacDonald Mines’ exploration work to date on the SPJ Project supports a gold-rich IOCG model for the Scadding Deposit (“Scadding”). The objective of the Company’s current 2,000-metres drill program at Scadding is to confirm and expand the high-grade gold zones of the deposit. To date, one (1) of six (6) holes drilled in the deposit’s North Zone have been reported. Results indicate that the deposit is made up of thick and stacked zones of high-grade gold mineralization (Sept. 26, 2019 News Release).

About the newly acquired claims

The claims fill two strategic gaps in a regional uranium anomaly associated with the Scadding Deposit. In addition, near the western boundary of the southern block of claims, MacDonald’s surface mapping program identified, at surface, zones of IOCG alteration enriched in hydrothermal magnetite. This iron oxide enrichment is also outlined by a positive magnetic anomaly in a regional airborne aeromagnetic survey, conducted by previous operators, on the property. An iron oxide alteration overlapped with a positive uranium anomaly is an indicator of potential zones of polymetallic mineralization and a hallmark of IOCG systems.

Quentin Yarie, MacDonald’s President and CEO commented: “The addition of these new claims fills some gaps in our property package. We know that the IOCG mineralization on the property extends beyond the footprint of the Scadding Mine and this acquisition provides us an opportunity to further investigate the uranium and iron oxide anomalies that are associated with the Scadding Deposit.”

Figure 1 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/11826763-11c1-44f2-b0a5-729d3ccca797

Terms of the transaction with Golden Copper Corp.

To acquire 100% interest in the claims owned by Golden Copper Corp., MacDonald Mines agrees to pay the seller $5,000 in cash and issue 1,875,000 of the Company’s Common Shares. The transaction is subject to TSX Venture Exchange approval and certain other customary closing conditions.

Qualified Person

Quentin Yarie, P Geo. is the qualified person responsible for preparing, supervising and approving the scientific and technical content of this news release.

About MacDonald Mines Exploration Ltd.

MacDonald Mines Exploration Ltd. is a mineral exploration company headquartered in Toronto, Ontario focused on gold exploration in Canada. The Company recently acquired the high-grade past-producing and permitted Scadding Gold Mine and is focused on developing its large SPJ Project in Northern Ontario.

The Company’s common shares trade on the TSX Venture Exchange under the symbol “BMK”.

To learn more about MacDonald Mines, please visit www.macdonaldmines.com

For more information, please contact:

Quentin Yarie, President & CEO, (416) 364-4986, [email protected]

Or Mia Boiridy, Investor Relations, (416) 364-4986, [email protected]

This News Release contains forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.